I do my best thinking when I have Microsoft Excel open. I can come up with a justification for anything by putting together a spreadsheet that convinces me of a financial return. Ten years ago, I was responsible for a global business unit with 1,500 employees and 7 global manufacturing plants. I was always quick to point out that labor cost was a company’s largest expense. Thus, higher profits came by figuring out the best labor arbitrage situation. In almost every Excel spread sheet I created, it pointed to moving our US manufacturing to China because of the sub $5 per hour wage rate (see figure 1). This was an easy decision for someone who was paid based on the company profits (and someone that did not live through World War II – I will explain the relevance of this later). Therefore, I made many decisions to offshore US jobs to lower wage rate countries. However, today is different for executives confronted with the decision to move production. There is more to the story. Many companies are actually moving jobs back to the US, a phenomenon known as the reshoring movement.

History of Off-Shoring

The United States has a history of both onshoring and off-shoring manufacturing. Our roots as an English colony in an international trading network laid the foundation to become one of the world’s largest manufacturing hubs. By the 1940’s, and the onset of Word War II, the US had generated a positive momentum, making it possible to switch from manufacturing millions of automobiles to manufacturing bombers and wartime industrial output (The Arsenal of Democracy by A.J Baime). This movement gave the confidence to US companies to compete in a global market. The World War II generation rarely thought about resourcing because of the patriotism created from the wartime manufacturing.

Then in the 1970’s the pendulum swung the other direction. Companies in a multitude of industries found themselves struggling with whether to offshore manufacturing. Off-shoring came at a great expense and tremendous risk, but the benefits over time appeared to justify the move. The result of this movement hit hard at home when China gained access to the World Trade Organization in 2001. As a result, the US lost nearly 2.5 million manufacturing jobs to China between 2000 and 2010 (1). Fast forward to 2021, when many of those same companies are now making calculations in the opposite direction as they consider reshoring manufacturing back to the US. How are they justifying the risky and costly decision to move back home?

The ROI of Reshoring

Many companies in the US are starting to re-think the value of reshoring some of its essential manufacturing. I had a discussion with Ethan Karp, President and CEO of MAGNET (2), about how companies are making the decision to bring back manufacturing production. Ethan talked about four important criteria that need to be considered in each of the companies ROI (Return on Investment) calculations when making this reshoring decision.

- Labor pricing: The reality is that US will never have competitive wages when compared to third world economies such as Vietnam. However, automation and new AI technologies are reducing the amount of human labor required to manufacture a product. So, my original assumption of “labor costs are a company’s largest expense” is being challenged today. If China is using 5 people for a certain manufacturing operation that can be done in the US using automation with only 1 person, one can envision the beginnings of a business case to move the production back to the US. Feedall Automation shares the business case many times on how our equipment reduces direct labor requirements on production lines. However, automation cannot be the sole answer. Rather it allows these other factors to become relevant in the decision to move production back to the US.

- Supply Chain Simplicity: The post-COVID world is fraught with supply chain disruptions. If you are involved with manufacturing today, you understand the frustration faced with trying to get your hands on components from oversees. Long lead-times and uncertainty of available products is causing many companies to consider better options. When you manufacture your products 5,000 miles away, you must spend extra time specializing your process in each market and need much more inventory. In contrast, localized production facilitates just-in-time manufacturing, which optimizes workflow to produce a more specialized product more quickly for less capital investment. This is one of the most overlooked costs when calculating the ROI on reshoring.

- Intellectual Property Protection: Intellectual property (IP) is not protected globally the way it is in the US. Some countries seem to encourage – or at least ignore – the theft of intellectual property. There is larger concern these days about the risk of new product technologies being copied, which can lead to decisions to manufacture new products in the US. The Office of the United States Trade Representative (USTR) reported earlier this year that China has “some improvements to IP enforcement, but uncertainty remains about the effectiveness of certain law changes” and that “longstanding problems such as bad-faith trademarks and counterfeiting persist (3).” The USTR also faulted China for new cybersecurity laws that are being abused to force companies to share intellectual property. I know from experience that the cost to defend intellectual property theft is significant and difficult to enforce oversees.

- Quality: One of the biggest offshoring disappointments has been low product quality, which increases manufacturers’ costs in many ways (customer reclamations, re-production, waste, and lost sales). By calculating how much you lose annually due to issues related to poor quality, you can estimate your potential savings in the reshoring scenario. For example, a tube manufacturer with an annual production capacity of two million units can reduce their warranty rate from 4% to 1% by moving production from China to a fully automated factory in the US. If each unit costs $10.00, then the annual savings would be $600,000.

A Note on Government Intervention: While I believe in free trade as a business owner, I see the real impact of government interaction when it comes to tariffs, free trade and the strength of the dollar. When trying to make big decisions to move or set up manufacturing facilities, these elements of your ROI equation are always uncertain. For example, the US corporate tax rate was 35%; higher than France at 34.1%, and twice as much as China at 16.6% and triple Taiwan at 10% 4 years ago. Today it is 21% and who knows what it will be tomorrow if Congress decides to make a change.

When evaluating a business case to re-shore production back to the US, use these (4) factors to help determine the cost savings vs the investment needed to justify the move. In my experience, a Return on Investment of less than 2 years is attractive to most reasonable business leaders. However, don’t forget to also factor in the ability to grow sales as a result of having production closer to your customers. This is the icing on the cake.

Is Reshoring Happening or is it just talk?

The jury is still out on how much reshoring will taking place. There are some indications that we are seeing some companies make moves to come back to the US. Harry Moser, founder and president of the Reshoring Initiative, shared “Reshoring 2010 thru 2019 totaled over 700,000 jobs, about six percent of total U.S. manufacturing employment.” (4) Another good resource is the Kearney Reshoring Index which measures the degree of reshoring that is actually occurring. This Reshoring Index tracks total manufacturing goods imported from 14 traditional offshoring partner countries, including China, as a percentage of US domestic gross output of manufacturing goods. After rising steadily over the last decade, imports from those 14 countries contracted 7.2 percentage in 2019 while the US manufacturing output remained steady (5). The 2020 results were not as encouraging, but they also were much harder to decipher given the noise created with COVID-related supply chain issues.

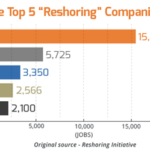

As far as the Forging Industry is considered, there were a handful of notable moves by companies choosing to bring production back to the U.S. Trenton Forging Co, Trenton MI, is a leader in the Forging industry and was founded in 1967. They won the 2020 National Metalworking Reshoring Award in recognition of their success in returning manufacturing back to the United States. In addition, one of Feedall’s customers is in the process of bringing manufacturing back from China with the use of two of our automated feeders for a railroad product. However, the most compelling data is to look the top reshoring companies in the US (see Figure 2). These are major customers for Forging companies. As they move back production, they will also look for their supply base to move locally in order to streamline their supply chains.

Conclusion

There is no silver bullet that tells companies what makes the most sense when considering reshoring their production. Everyone has their own thoughts that are laced with opinion and over-ambitious forecasts. However, I always come back to my trusted MS Excel workbooks. By looking at the four reshoring criteria, you can have a foundation for a proper ROI analysis to present to your leadership team. And as always, I am here to help if you have any questions on how to get started with your business case.

Author Jon Cocco is the owner and CEO of Feedall Automation in Cleveland, Ohio. He may be reached at jcocco@feedall.com or 440-942-8100 or follow him on LinkedIn at www.linkedin.com/in/joncocco/. For additional information, visit www.feedall.com.

References:

- The Balance “US Manufacturing Statistics and Outlook”, October 2019

- MAGNET is a Cleveland based consulting agency. For more than 30 years, MAGNET has been driving Northeast Ohio’s manufacturing growth by supporting small- and mid-sized manufacturers.

- Wall Street Journal: U.S. Says China Must Do More to Protect Intellectual Property, by Josh Zumbrun, April 30, 2021

- Two Companies Win 2020 National Metalworking Reshoring Award. By Reshoring Institute, October, 2020.

- Kearney Reshoring Index.

- The New American Reshoring Movement By the Numbers

Figure 1: Average hourly cost of manufacturing workers

Figure 2: Top 5 Reshoring Companies (6)